38+ can you deduct your mortgage interest

Your home must act as security for the loan and your mortgage documents must clearly state that. 16 2017 the maximum you can deduct goes up to 1 million for individuals and 500000 for married couples filing separately.

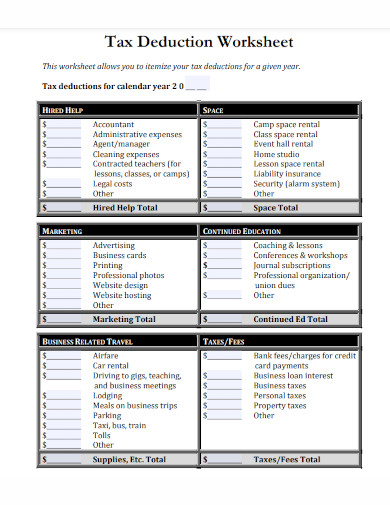

Tax Deduction Examples Pdf Examples

Web If you took out your mortgage on or before Oct.

. Web You may be able to deduct 100 of your mortgage interest paid in the previous year or only a portion of it depending on the size of your mortgage and when you acquired the debt due to the way tax rules have changed. The standard deduction is 19400 for those filing as head of household. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

For taxpayers who use married filing separate status the. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Web If youve closed on a mortgage on or after Jan.

If you took out your home loan before Dec. Secured by that home. 750000 if the loan was finalized after Dec.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. Rules on rentals There is a catch. Note that if you were under contract.

Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender. Web You are able to deduct the mortgage interest on either your primary residence or second house. And lets say you also paid 2000 in mortgage insurance premiums.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The type of deduction you claim on your federal income tax determines if you use your mortgage interest deduction. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million.

Beginning in 2018 this limit is lowered to 750000. ITA Home This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage-related expenses. Also if your mortgage balance is 750000 or less or 1.

Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. If you are single or married and filing jointly and.

The top amount is 750000 starting in 2018. 13 1987 your mortgage interest is fully tax deductible without limits. Web Used to buy build or improve your main or second home and.

1 million if the loan was finalized on or before Dec. The most that could be deducted for debt before 2018 was 1 million. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017.

Web Bankrates Mortgage Interest Deduction Calculator can give you an idea of the math youll need to do. The loan must be secured by principal residences aka a main home or second home that you use through a deed of trust mortgage or land contract. You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year.

Existing mortgages will continue to be taxed in accordance with the same guidelines as before as of December 14 2017. Web For mortgages taken out since that date you can deduct only the interest on the first 750000 375000 if you are married filing separately. Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for married taxpayers who. That means for the 2022 tax year married couples filing jointly single filers and heads of households could. In addition to itemizing these conditions must be met for mortgage interest to be deductible.

Web You cant deduct the principal the borrowed money youre paying back. Now the loan limit is 750000. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

As a mortgage holder you have one of two types of mortgage debt in the eyes of the IRS. You must also have a contractual obligation to pay the loan back. The deduction is only available if you choose to itemize your deductions instead of.

Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. The loan is secured which means the lender has some kind of guarantee of payment usually in the form of property. If you bought your home after December 15 2017 though your deduction is capped for interest on the first 750000 of mortgage debt.

Homeowners who bought houses before December 16 2017 can. If you use a standard deduction you cant deduct your mortgage interest. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

So lets say that you paid 10000 in mortgage interest. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. 5 Home Construction Loans.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. So your total deductible mortgage interest is 12000 on your next tax return.

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction How It Works In 2022 Wsj

Fxpro Review 2023 Should You Sign Up Or Not Test

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Mortgage Interest Deduction Bankrate

38 Garage Design And Storage Ideas Garage Design Garage Renovation Garage Remodel

Is Frankfurt Dull Quora

The History And Possible Future Of The Mortgage Interest Deduction

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Tax Deduction Examples Pdf Examples

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Mortgage Interest Deduction How It Works In 2022 Wsj

Tax Deduction Examples Pdf Examples

What Is The Mortgage Interest Deduction The Motley Fool